-

33 minutes ago

Back to all articles

Pound hits highest level since Brexit vote

Pound hits highest level since Brexit vote

Image copyrightGETTY IMAGES

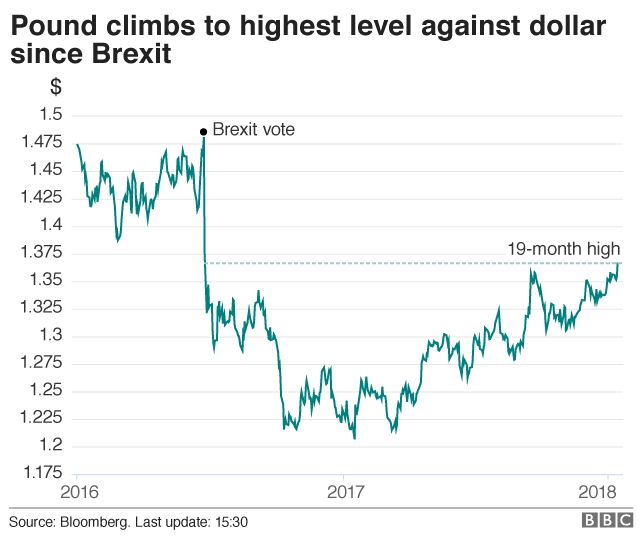

Image copyrightGETTY IMAGESSterling has jumped to its highest level against the US dollar since the Brexit vote.

The surge to almost $1.37 came after Bloomberg reported that the Spanish and Dutch finance ministers had agreed to seek a Brexit deal that kept the UK as close to the EU as possible.

The pound rose more than 1% to $1.3691, its highest level since 24 June 2016.

The currency had been trading at about $1.50 before the result of the referendum became clear.

Later on Friday, sterling gave up some ground to trade at $1.3666.

Mizuho analyst Neil Jones said the Bloomberg report was less significant than the sterling rally suggested.

“Just because two of the 27 members say this, it doesn’t mean a softer Brexit will happen. I doubt it’s as straightforward as that,” he said.

Neil Wilson at ETX Capital said: “Although the comments came from just two ministers who don’t necessarily speak for the Barnier team as such, there is a sense that the direction of travel for the UK with regards Brexit is a lot more positive than it was prior to December.

“We also have positive language around financial services and the prospect of Britain paying for market access.”

Nomura currency strategist Jordan Rochester added: “I’m sceptical this [report] is necessarily a game-changer at this stage as there will also be member states pushing the other way.”

The pound was almost flat against the euro at €1.1262 after the single currency hit a three-year high against the dollar following hopes that chancellor Angela Merkel would be able to form a coalition government in Germany.

“Sterling is benefiting from the dollar weakness and the growing euro strength rather any pound-specific factors, which if anything have been underwhelming this week,” said Alvin Tan at Societe Generale.

Some traders are concerned that poor Christmas trading reported by several retailers this week was further evidence of a consumer slowdown as inflation erodes spending power.